Student financial stress is higher than ever. A CreditWise survey1 found the majority of college-age individuals experience financial stress. When asked to list their top stressor, “financial” was the top answer overall, but Gen Z and Millennials felt it even more:

- Overall respondents – 73%

- GenZ – 82%

- Millennials – 81%

Unfortunately, financial stress wreaks havoc with your students mentally, physically, emotionally, and socially. Those experiencing financial stress report more mental health issues, inability to sleep, poor self-esteem, and difficult relationships with others.

Just as important is that students who are financially stressed aren’t doing well in school.

Students with high financial stress are more likely to leave homework uncompleted, drop classes, or drop out of school altogether2. Even if students manage to stay in school, they are far more likely to take longer to graduate3.

The solution is financial literacy. A FINRA study4 found that financial stress is directly related to poor financial behaviors and decisions. These come about due to poor financial literacy.

When financial literacy is increased and behaviors improve, financial stress decreases.

Here are five ways a student financial wellness program can reduce student financial worries and increase financial control.

1. Keeping Track of Spending

An AICPA survey found that only two out of five students follow a budget5. Without a budget, students have no way of knowing how much money they have coming in, how much they need, or how much money is going out.

In fact, having a budget is key to reducing financial stress. Here’s why:

- Reduces poor financial habits: When students are taught to track their money by budgeting, they will be able to take note of, and change, poor spending habits. This is especially true when coupled with a financial wellness program that helps students take positive actions instead of merely providing information.

- Highlights goals: It is impossible to reach a goal you don’t set. Budgeting helps students set goals, and then make a plan to reach them.

- Shows where they have control: When students have a budget, they can focus their attention on the portions of their financial situation where they have control. There is very little they can do about the cost of needs, but they can change how they spend their money on their wants.

Internal iGrad data shows that those who never use a budget have an average stress rating 10.4% higher than those who do.

In other words, when students budget, they feel more confident and in control.

In turn, this helps to reduce stress, anxiety, and frustration6.

2. Understanding Financial Aid

By graduation, 70% of students have amassed at least some student loan debt7. However, a majority of these students do not understand the loans they received.

A College Ave Student Loans Survey8 found that students do not understand:

- Loan terms (63%)

- Eventual loan payment amount (70%)

- That they must pay the loan back (50%)

Students also do not understand that they don’t have to accept the full amount of the loan offered to them or how to best use the loan money given to them as a refund after the payment of tuition, fees, and room and board.

Instead of using the money on needs, many students spend the money on entertainment and pay interest on that fun for years following graduation.

Unfortunately, high student loan debt leads to stress.

Three out of five borrowers say that student loan debt has negatively affected their mental health9.

That’s why it is important for students to understand their loans and the impact those loans will have in the future.

Financial wellness can help students understand their award letters, use their loan money wisely, and find ways to reduce the amount of money they need to borrow to finish school.

3. Staying Out of Debt

Debt stresses out American adults. A recent National Debt Relief survey10 found that financial worry caused:

- Lost sleep

- Nightmares

- Withdrawal from activities

- Poor mental health

And although traditional students come to campus with no debt, they often leave with credit card balances in addition to student loans.

In fact, a TransUnion report found that the average Gen Z’er has a $1,600 credit card balance and only half of students pay their credit card bill in full each month11.

Internal data from Enrich, a sister company of iGrad, found that 28% more users pay off their credit cards each month when using the program12.

By offering a financial wellness program, colleges, and universities can help students now and well after graduation.

4. Saving for Emergencies

Unexpected expenses can be very distressing to students, especially if they have not considered the possibility of the expense or how they would cover it.

When the unexpected happens, students are far more likely to experience negative emotions that reduce their ability to problem solve, such as fear and anger13.

The best way to avoid negative emotions and poor decision-making is preparation.

Financial wellness programs teach students about financial emergencies, but more importantly, how to prepare for them in advance through a vehicle such as an emergency savings fund.

The Student Financial Wellness Survey14 found that most college students have no emergency savings. 63% have no idea how they would handle a $500 expense, with many turning toward credit cards or high-interest loans. Doing so only increases the problem.

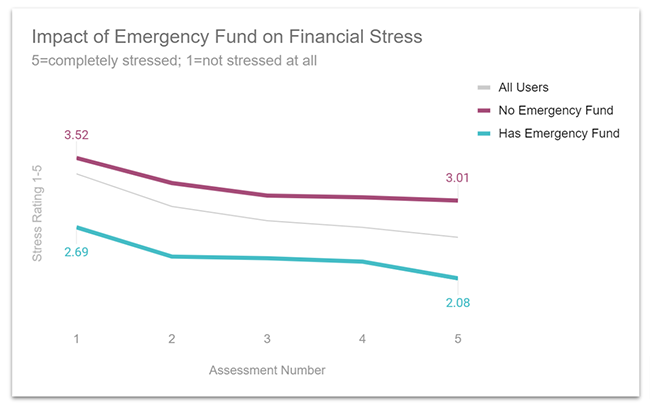

Enrich data shows that using the financial wellness program increases the likelihood of having an emergency fund by 27%. Plus, having such a fund decreases stress.

5. Asking for Help

A recent RIA study15 discovered that students were more likely to “fake it” than to ask for help when it came to financial matters. In fact, 40% of students pretend to know what they are doing and simply hope they will figure it out eventually.

But this method leaves students making poor decisions like taking too much financial aid, using credit cards incorrectly, or assuming that they won’t have to pay off their loans if they don’t graduate from college.

Most students state they get their information from:

- Parents

- Social media

- Friends

Unfortunately, these sources may not be accurate and the people may not be fully informed.

iGrad offers one-on-one counseling, and when coupled with financial aid counseling, can help students find answers to their financial questions.

Without a doubt, your students are going to experience the stress that comes with financial problems. However, a strong financial wellness program can help them gain control and reduce stress.

1 - https://www.prnewswire.com/news-releases/survey-reveals-tension-between-financial-stress-and-optimistic-financial-outlook-among-us-consumers-300940048.html

2 - https://news.osu.edu/70-percent-of-college-students-stressed-about-finances/

3 - https://journals.sagepub.com/doi/10.2190/CS.16.3.c

4 - https://gflec.org/wp-content/uploads/2021/04/Anxiety-and-Stress-Report-GFLEC-FINRA-FINAL.pdf?x85507

5 - https://www.journalofaccountancy.com/news/2015/sep/financial-literacy-skills-201512981.html

6 - https://www.cfp.net/-/media/files/cfp-board/knowledge/reports-and-research/consumer-surveys/consumer-views-on-cash-flow-planning-january-2019.pdf

7 - http://collegeaffordability.urban.org/covering-expenses/borrowing/

8 - https://www.trelliscompany.org/wp-content/uploads/2019/06/Fall-2018-SFWS-Report.pdf

9 - https://www.surveymonkey.com/curiosity/cnbc-invest-in-you-jan-2022/

10 - https://www.nationaldebtrelief.com/how-debt-affects-your-mental-and-physical-health/

11 - https://everfi.com/white-papers/financial-education/money-matters-report-19/

12 - https://www.enrich.org/financial-wellness-behavior-change-data-study

13 - https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2908186/

14 - https://www.trelliscompany.org/wp-content/uploads/2019/06/Fall-2018-SFWS-Report.pdf

15 - https://blog.riamoneytransfer.com/en/financial-literacy-personal-finance-survey/